Equipment depreciation calculator

Using the calculator To calculate your approximate monthly payments simply fill in the calculator fields equipment cost lease type lease term interest rate and click on Calculate. This makes the assumption that your heavy equipment will depreciate at the same rate every year of its useful life until it reaches its salvage value.

Manufacturing Equipment Depreciation Calculation Depreciation Guru

Common assets that depreciate quickly include equipment cars phones and even rental properties.

. There are many variables which can affect an items life expectancy that. This limit is reduced by the amount by which the cost of. Book value cost value annual depreciation x age For example if five years ago you purchased construction equipment for 20000 it will depreciate about 2000 every.

There are many variables which can affect an items life expectancy that should be taken into consideration. There are many variables which can affect an items life expectancy that should be taken into consideration. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

There are many variables which can affect an items life expectancy that should be. There are many variables which can affect an items life expectancy that should be taken into consideration. High-Tech Medical Equipment Depreciation Calculator The calculator should be used as a general guide only.

The calculator should be used as a general guide only. The calculator should be used as a general guide only. This depreciation calculator will determine the actual cash value of your Calculator using a replacement value and a 10-year lifespan which equates to 01 annual depreciation.

Section 179 deduction dollar limits. High-Tech Medical Equipment Depreciation Calculator The calculator should be used as a general guide only. The calculator should be used as a general guide only.

Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. One way to calculate depreciation is to spread the cost of an asset evenly over its.

The calculator should be used as a general guide only. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. There are many variables which can affect an items life expectancy that should be taken into consideration.

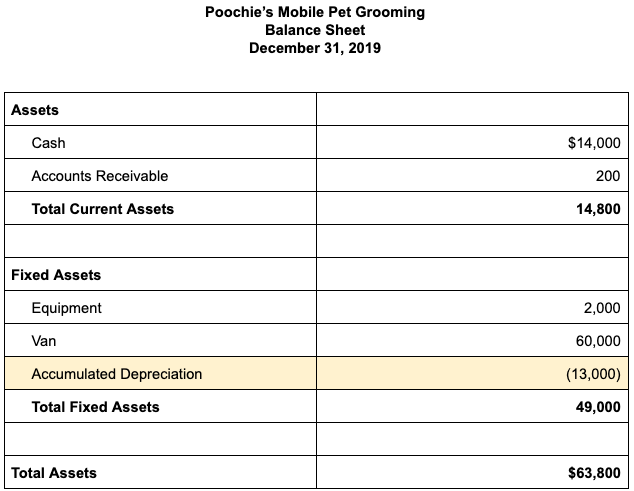

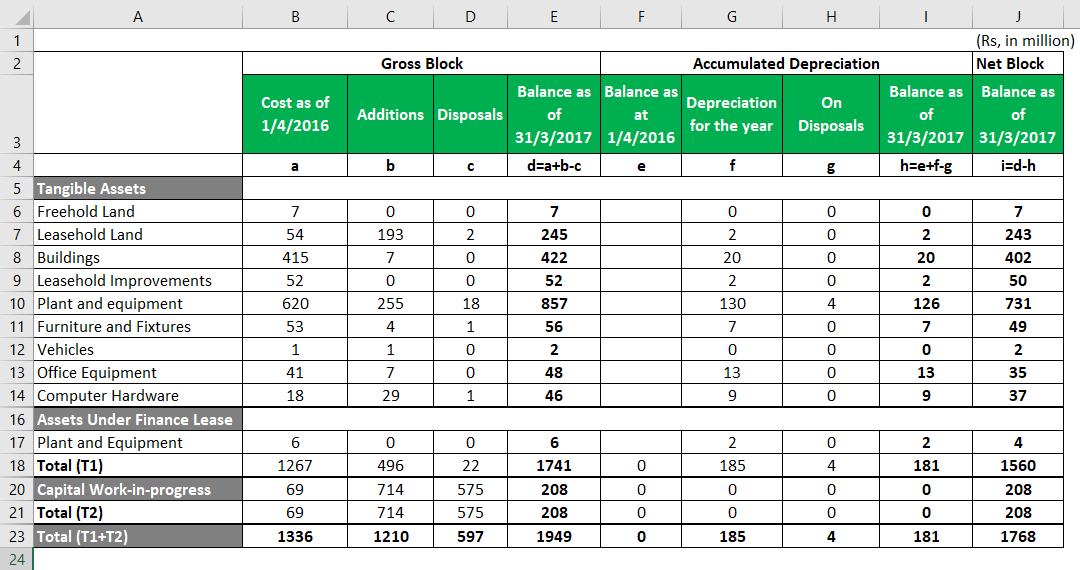

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

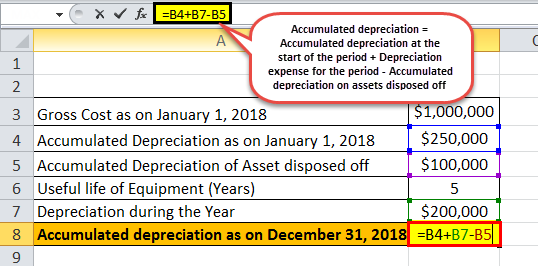

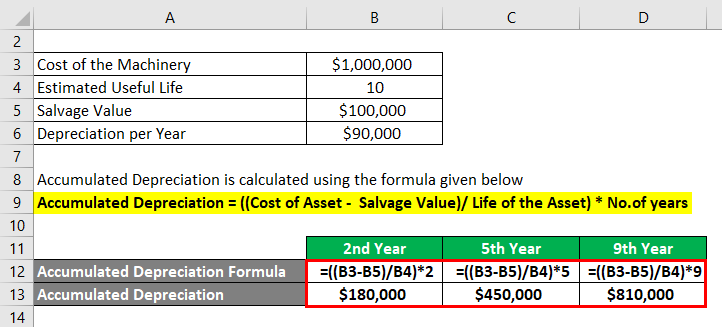

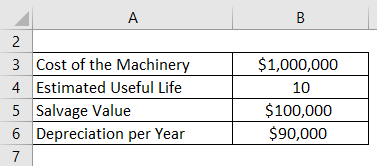

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Expense Double Entry Bookkeeping

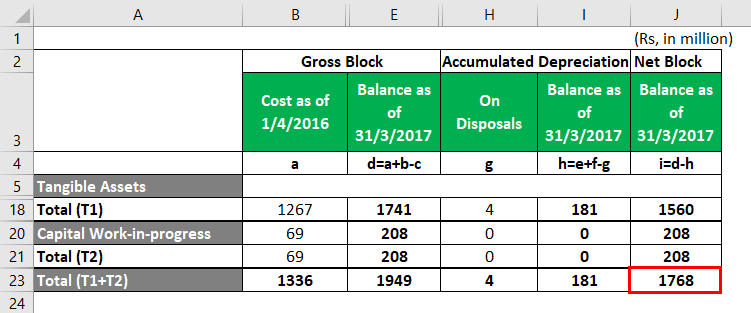

Accumulated Depreciation Formula Calculator With Excel Template

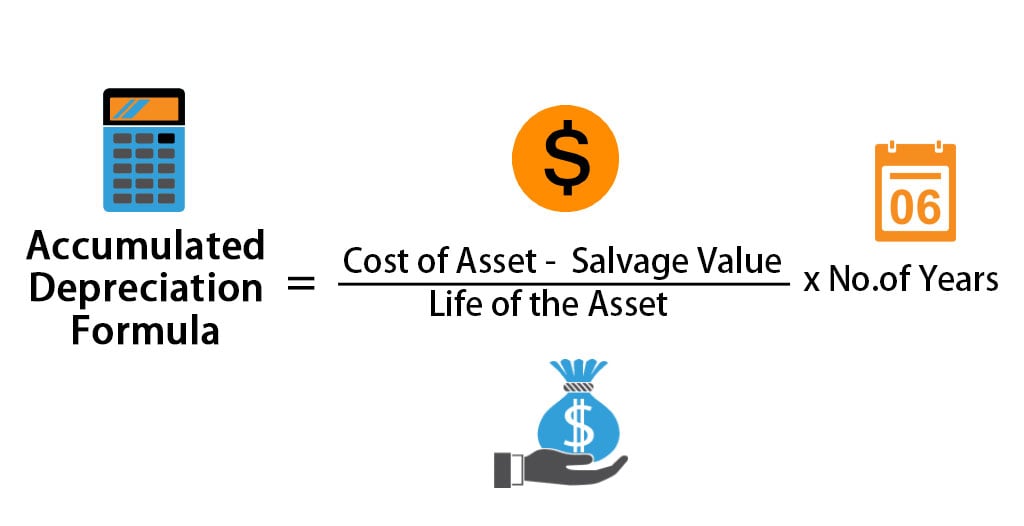

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

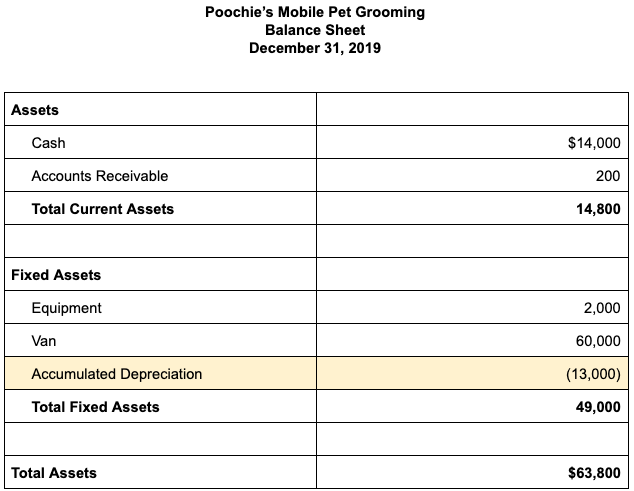

Accumulated Depreciation Explained Bench Accounting

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Declining Balance Depreciation Calculator

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Formula Calculator With Excel Template