27+ franking credit calculator

Franking Credits accepts no responsibility with regard to any financial or taxation. Web Franking Credit Amount of Dividend 1 Tax Rate on Company Profits Amount of Dividend Using the figures given above.

Franking Credits Calculator Video Explainer

The information contained in this website is factual in nature and has not taken into account your personal situation.

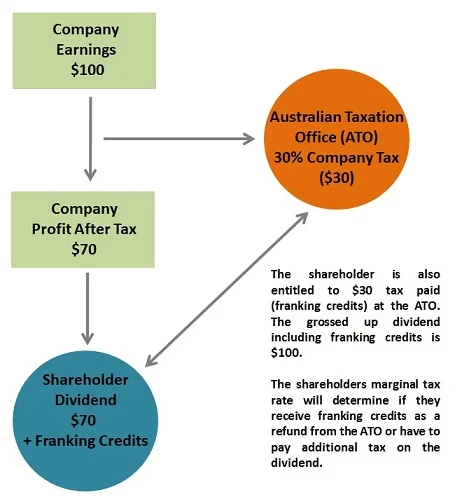

. Web A franking credit is a tax credit paid by companies to their shareholders at the same time as dividends are paid. The page Includes a Calculator to work out Franking credits. Try Simplifi for free today.

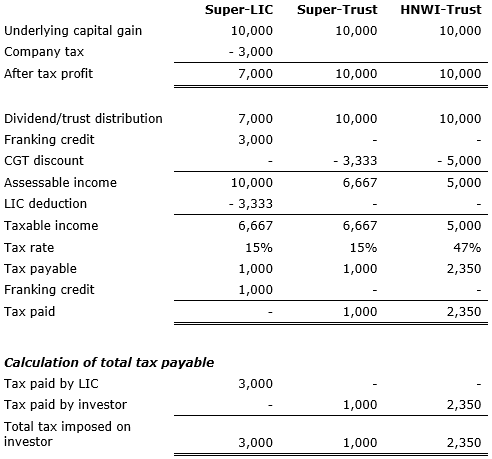

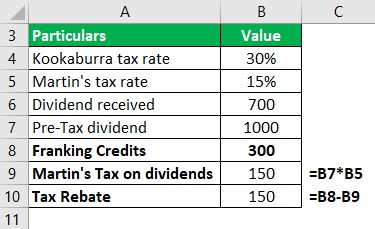

Franking Credits Dividend 1 - Company Tax Rate - Dividend Franking Percentage Since the full company tax rate is 30 the above formula can be simplified as. Applicable gross up rate 100 275 275 26364 maximum franking credit 100000 1 26364 3793051. Nows the Time to Check In On Your Credit with TransUnion.

Web Franking credit refund calculator - Franking credit refund calculator is a software program that helps students solve math problems. Add the two amounts to get your grossed-up. Take out the guesswork with credit.

The franking credit 4286. For a 50 franked dividend enter. Web Franking credit Percentage.

100 1 - 030 - 100 4286. Web Demystify Investing with Our Franking Credits Calculator Pearler Our easy-to-use Franking Credits Calculator allows you to figure out how much your franking credits are worth. Web Online franking credit calculator coming soon.

Last Updated 11 February 2021. Web Franking Credits Dividend Amount 1-Company Tax rate Dividend amount Here the Dividend amount is the amount paid by the company as dividends. The ATO refunds the franking credit.

03 9005 5762. Ad Manage your finances with confidence ease. A simple Franking Credits Imputation Credits Calculator that will calculate how much in franking credits youll receive on your cash dividends.

The fields below will show the franking credits attached to each shares dividend and the total amount you may have stored at. Franking Credit 70 1 30 70 30 In other words apart from the dividend amount of 70 each shareholder is. Dividend 3.

Web Lee is a shareholder of a large corporate company and receives a fully franked dividend of 100 from an Australian resident company that has a corporate tax rate of 30. The company tax rate refers to the rate which the company is entitled to pay as per the tax bracket. Lees franking credit would be.

Web Your total taxable income on these dividends would be dividend received in cash and franking credits so 1400 600 2000. A dividend of 10000000 paid by a company with an imputation tax rate of 2750 and franked to. Get Your Score Powerful Tools.

For a fully franked dividend enter 100. Franking Credits are a type of tax credit that allows Australian Companies to pass on tax paid The page Includes a Calculator to. Web Dividend Franking Credits Calculator.

Web If the dividend above was only 50 franked we simply adjust the franking credit by the percentage. On a marginal tax rate of 30. Pinpoint whats most affecting your scores.

On a marginal tax rate less than 30. Stay on top of bills keep funds organized crush your financial goals. Web A dividend of 10000000 paid by a company with an imputation tax rate of 2750 and franked to 5000 Franking Credit Calculator.

Ad Put Your Credit Plan in Place with Tools You Wont Find Anywhere Else like CreditCompass. The dividend is not taxed. Since corporations have already paid taxes on the dividends they distribute to their shareholders the franking credit allows them to allocate a tax credit to.

Franking Credits at 100 30 Franking Credits at 50 30 05 15 In this partial franked example the grossed up dividend would only be 85 as the dividend. Web Franking Credits are a type of tax credit that allows Australian Companies to pass on tax paid at the company level to shareholders. Web On a marginal tax rate greater than 30.

Build Your Future With A Firm That Has 85 Years Of Investing Experience. Web The maximum franking credit it can attach to that distribution based on the above formulas is calculated as follows. Lets say your individual marginal tax rate was 40 that would mean the tax owing on this 2000 at 40 800.

Ad Our Expert Investment Professionals Aim To Maximize Returns And Strive To Manage Risk. Ad We fill in the gaps that other credit score providers simply dont. Web The franking credits on your dividends can be calculated using this formula.

The franking credit is credited against your marginal rate with tax paid on the difference.

Partially Franked Dividends Youtube

What Are Franking Credits And How Do You Calculate Them Finder

Dividends Franking Credits Explained Including Formula My Money Calculator Investment Property Shares Super

Franking Credits With Less Downside Risk Business Research And Insights

The Best 9 Databox Alternatives In 2023 In Depth Comparison

Franking Credits Calculator Video Explainer

Idual Recessed Led Ceiling Light Argon 8 5 X 8 5 X 5 5 Cm Amazon De Lighting

Franking Credit Formula Examples How To Calculate

:max_bytes(150000):strip_icc()/dividends_-5bfc322a46e0fb0051bf118a.jpg)

What Are Franking Credits Definition And Formula For Calculation

What S A Franking Credit What S Dividend Imputation And What S Retiree Tax Loanscape

Basics Of Franking Credits Calculator Market Index

Franking Credits And Dividends 101 Youtube

How To Calculate Franking Credits On Your Portfolio Sharesight Blog

Who Will Be The Losers Under Labor S Proposed Franking Credit Change Unity Partners

Franking Credits Limits Individuals Franking Credits

Franking Credits Calculator Video Explainer

Huggies Snug Dry Baby Diapers Size 5 Fits 27 Lb 88 Count Giga Jr Pack Packaging May Vary Amazon Ca Baby